Text Size

Menu

close

The Fund’s “Long-Term Investment Objective” is to meet or exceed a real rate of return (net of inflation, as measured by the US Consumer Price Index: All Urban Consumers not seasonally adjusted) in US dollars over the long-term (15 years and longer) without undue risk of loss, that factors in the liabilities of the Fund and the Required Contribution Rate as defined in the Funding Policy. In the short term (3 years), the Fund aims to meet or exceed the Policy Benchmark’s returns while keeping Key Risk Indicators in line with OIM’s Risk Management Framework.

Click here to see the Funding Policy.

Management of the investment of the assets of UNJSPF is the fiduciary responsibility of the Secretary-General of the United Nations, in consultation with the Investments Committee, and in the light of observations and suggestions made from time to time by the Pension Board in relation to the investment policy.

The Representative of the Secretary-General (RSG) for the investment of the assets of the Fund has the responsibility and authority to act on behalf of the Secretary-General in all matters involving the fiduciary duties of the Secretary-General relating to the investment of the assets of the Fund, including representing the Secretary-General at meetings of the Investments Committee, the Pension Board, and other meetings where investment matters pertaining to UNJSPF are discussed.

The Representative of the Secretary-General is assisted by OIM. Investments must, at the time of initial review, meet the criteria of safety, profitability, liquidity and convertibility.

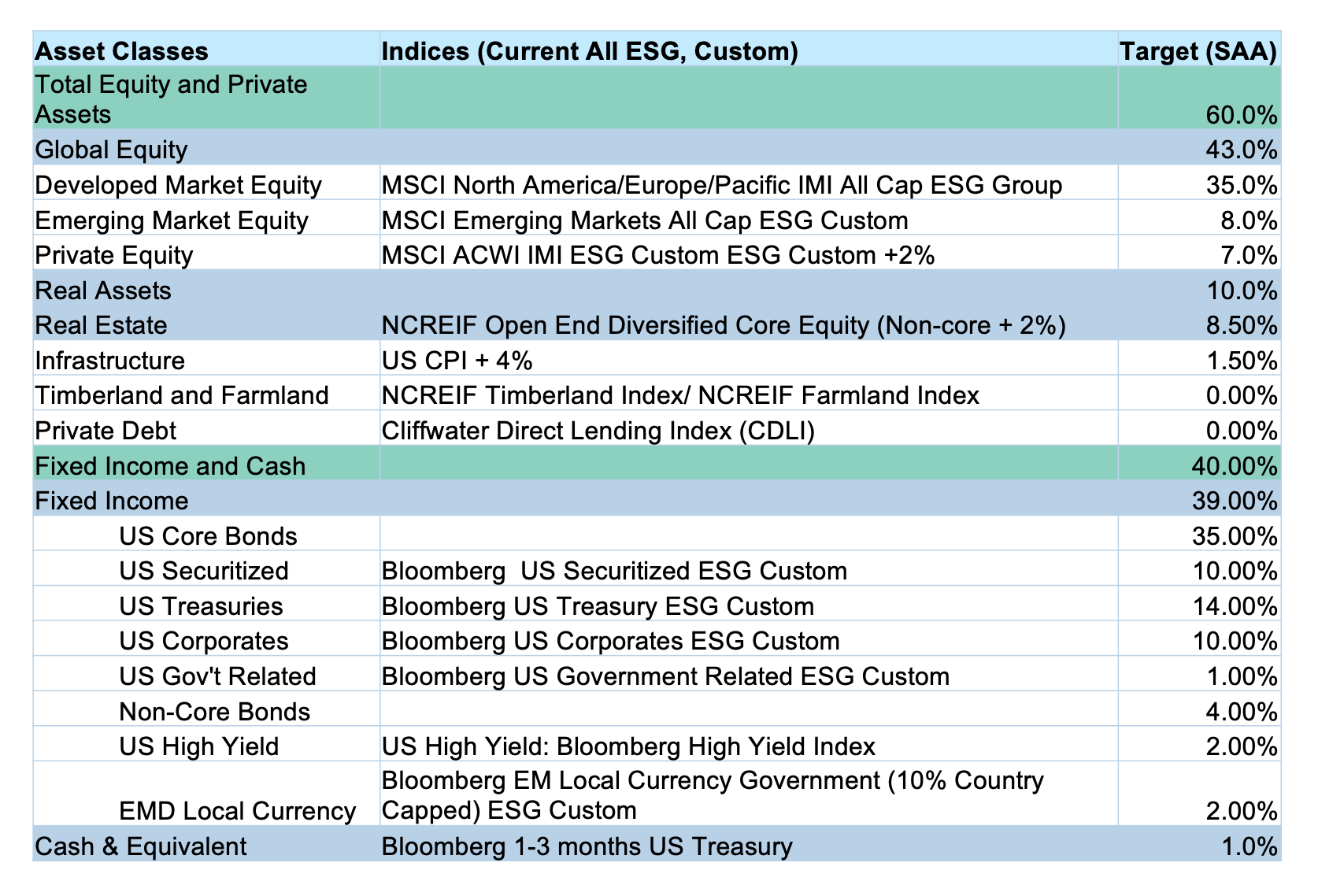

Investments are carried out within the framework of the Investment Policy Statement (IPS). The purpose of this Investment Policy Statement (IPS) is to set forth the parameters which shall guide the RSG and OIM staff in managing the investment of the assets of the UNJSPF. The IPS specifies the Long-Term and Short-Term Investment Objectives; the eligible investment universe of asset classes, investment channels, and investment instruments; the Strategic Asset Allocation (SAA) and the Policy Benchmark; the risk parameters; and the investment process.

A full-scale review and updating of the IPS is undertaken in consultation with the Investments Committee and other stakeholders, and in light of the observations and suggestions provided by the United Nations Joint Staff Pension Board (Pension Board or UNJSPB) and taking into account the results of each Asset Liability Management (ALM) Study, conducted once every four years.

The IPS is a living document and will be continuously updated, amended and enhanced as needed by the RSG, in order to provide the Fund with the necessary flexibility and tools required to address specific market conditions or developments.

The Investment Policy Statement was last updated in 2025.

The Reference Portfolio, a notional strategic allocation designed through periodic Asset Liability Management studies and actuarial studies by the Committee of Actuaries (typically every four and two years, respectively), serves as the primary expression of the Fund's long-term risk-return target. It functions as a governance anchor, representing the optimal mix of asset classes that would be held passively to meet the Fund's financial objectives with prudent levels of risk. Currently, the Reference Portfolio is aligned with the Strategic Asset Allocation outlined in the Investment Policy Statement (IPS) 2023. A more detailed configuration will be developed following the next ALM study scheduled for 2027.

The Fund constructs its portfolio through a multi-asset framework in which each asset class fulfills a defined functional role. Asset class exposures are implemented with clear reference to their contribution to the total Fund’s return profile, risk budget, liquidity requirements, and strategic objectives. While the Fund operates under a total portfolio mindset, the differentiation of asset class roles supports structural clarity, oversight, and performance attribution.

Strategic Role

Public equities serve as the Fund's primary source of long-term capital appreciation and growth. They provide scalable access to global corporate value creation and offer exposure to economic expansion, productivity gains, and technological innovation.

Portfolio Design and Implementation

The equity portfolio is constructed to ensure:

Oversight Considerations

Public equity mandates are monitored for performance consistency, factor tilts, tracking error, liquidity, and alignment with responsible investment standards. Concentration risk is evaluated across regions, sectors, and issuers.

Strategic Role

Fixed income assets provide capital preservation, income generation, and liability matching characteristics. They also play a critical role in mitigating overall portfolio volatility and providing liquidity under stress.

Portfolio Design and Implementation

The fixed income allocation might include:

Duration, yield curve positioning and credit exposures are actively managed to reflect macroeconomic outlook, interest rate risk, and the Fund's liability profile.

Oversight Considerations

Mandates are subject to credit quality thresholds, issuer concentration limits, and stress-tested interest rate sensitivities. Liquidity and counterparty exposures are monitored continuously.

Private markets offer diversification, long-term return potential, and access to differentiated sources of value creation. As traditional public market returns compress and volatility rises, private equity, private credit, real estate, and real assets are essential components for achieving OIM’s long-term investment objectives. These asset classes typically exhibit lower correlation with public equities. They can provide illiquidity premia in exchange for longer investment horizons, aligning well with the long-duration liabilities of defined benefit pension plans.

OIM integrates private markets in a robust governance framework, deep due diligence capabilities and a strategic approach to portfolio construction. OIM implements disciplined pacing strategies to smooth capital deployment over time, maintain portfolio balance, and avoid vintage-year concentration. Risk-adjusted return expectations are evaluated across cycles, and performance benchmarking considers the unique characteristics of each private market strategy.

Furthermore, incorporating environmental, social, and governance (ESG) factors and responsible investing principles into private markets is increasingly seen as a value driver and risk mitigant, particularly in infrastructure and real assets. Liquidity risk will be carefully managed, ensuring the overall portfolio maintains sufficient flexibility to meet pension obligations, even during stressed market conditions.

Strategic Role

As a key component of OIM’s Private Markets approach, private equity and private credit offer the potential for enhanced long-term returns through exposure to illiquidity premia, growth-stage businesses, and differentiated risk-return profiles that are unavailable in public markets.

Portfolio Design and Implementation

The private equity and private credit program includes:

Commitments are structured to balance opportunity capture with prudent management of unfunded obligations and capital calls.

Oversight Considerations

All private market strategies are subject to rigorous due diligence, operational risk review, valuation oversight, and liquidity planning. Valuation policies must adhere to recognized industry standards.

Strategic Role

Real estate and real assets contribute to portfolio diversification, provide inflation-linked income, and deliver long-duration cash flows. They also serve as a partial hedge against unexpected inflation and economic dislocation.

Portfolio Design and Implementation

The Fund invests in:

Oversight Considerations

Real estate and real assets are monitored for leverage ratios, tenancy risk, operational sustainability, valuation, frequency, and asset lifecycle considerations. Environmental, social and governance impacts are assessed at acquisition and throughout the holding period.

Strategic Role

Cash and short-term instruments support operational liquidity, capital call readiness, portfolio rebalancing, and market contingency planning. They serve as a principal preservation buffer with minimal risk exposure.

Portfolio Design and Implementation

Cash is managed through tiered liquidity pools, calibrated to:

Instruments include Treasury-bills, repurchase agreements, high-grade commercial paper, and short-duration investment-grade bonds, all subject to strict maturity, credit, and counterparty risk constraints.

Oversight Considerations

Liquidity pools are managed for accessibility, transparency, and policy compliance. No speculative activity is permitted within cash portfolios.