Text Size

Menu

close

Creating long-term value for the Fund's participants, retirees and beneficiaries entails numerous activities, one of which is engagement. As our newly published engagement report details, this pillar of our Responsible Investment strategy comprises three forms of dialogue with issuers:

“Our voice as one of the world’s largest asset owners is a powerful tool for creating long-term value and sustainability. We can’t do it alone, and we encourage other asset owners to join us in continuously pushing for improved practices,” said Toru Shindo, Chief Investment Officer and Acting Representative of the Secretary-General.

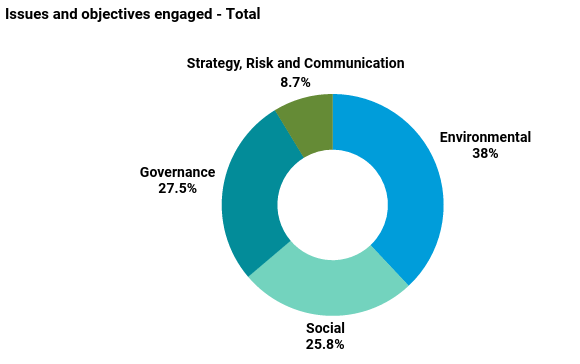

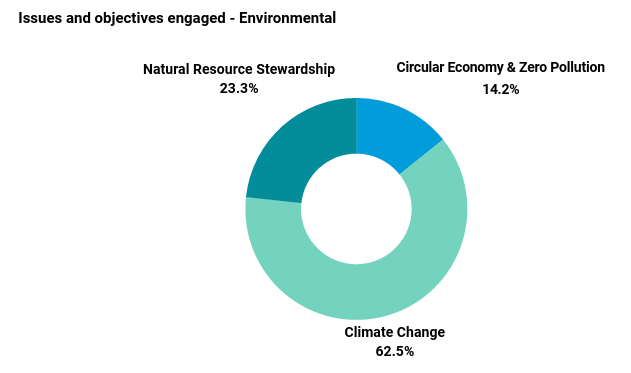

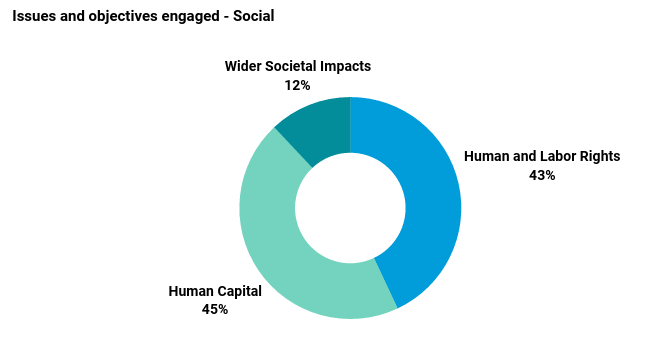

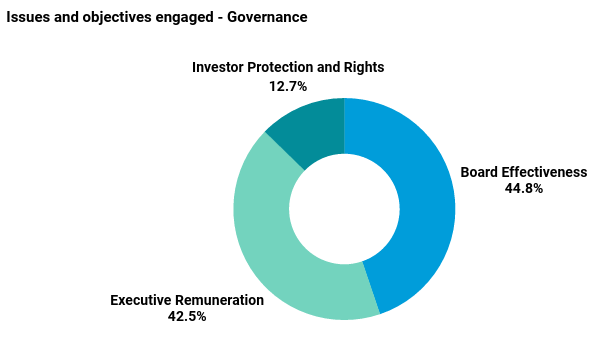

The UNJSPF’s engagement scope with Federated Hermes EOS covers four categories, each with three themes, as shown in the table below. In 2024, EOS engaged 655 companies on the Fund’s behalf.

| Category | Themes |

| Environmental | Climate change action |

| Circular economy and zero pollution | |

| Natural resource stewardship | |

| Social | Human capital |

| Human and labor rights | |

| Wider societal impacts | |

| Governance | Board effectiveness |

| Executive remuneration | |

| Investor protection and rights | |

| Strategy, risk and communication | Risk management |

| Corporate reporting | |

| Business purpose, strategy and policies |

Environmental was the most commonly engaged category by EOS on the Fund’s behalf in 2024.

The UNJSPF maps its engagement activities to the SDGs, as shown below. Notably, SDG 7, “Affordable and clean energy”, and SDG 2, “Zero Hunger”, each more than doubled relative to 2023 in terms of their prominence. This reflects the importance to the UNJSPF of the transition of energy and food systems to a low -carbon economy, given their importance to the Fund achieving its climate targets and commitments.

Regarding collaborative engagement, highlights include participation with Climate Action 100+, Nature Action 100, FAIRR Initiative and Climate Engagement Canada. The newly issued report contains more details, including public policy highlights and several case studies.